The COVID-19 pandemic will bring a recession unlike any seen before, one that will see many brands cut advertising budgets – but it will also accelerate existing digital transformation trend lines and produce new ones.

That is the view of Sir Martin Sorrell, executive chairman of his S4 Capital vehicle and former WPP CEO.

Sorrell has a voracious thirst for economic data, always quick to join the dots and cast forward on high-level economic trends.

“We’re in the eye of the hurricane,” he says in this interview with Beet.TV’s Andy Plesser, conducted over Zoom. “All the projections for Q2 are pretty awful. Goldman’s latest projection … for the US economy is GDP down 34%… It is pretty grim conditions at the moment.”

Tech carries on spending

Sorell predicts a “V-shaped” recession, in which economies would bounce back in Q4 and the “panic mode” will be over.

But he concedes Q2 will be “very painful”, saying that his clients are enduring ” extreme pressure and pain.”

“What we see is the tech companies maintaining their patterns of spend,” Sorrell says. “They are deploying their budgets still.

“(But) the FMCGs, the pharma companies, less so. Retailers, travel and hospitality have been hit badly. Those companies are certainly cutting their budgets – delaying and deferring and cutting.

“But they are switching money to digital. I’m not just saying that. We are seeing a view developing that there should be an acceleration of this switch to digital … which will be permanent.”

A new digital dawn

Sorrell is cautious to say he is not advocating brands should “spend your way out of this”, and he is aware that his own company’s bread-and-butter is, indeed, brands that either are digital or spend digital. But he does see three digital-growth trend lines emerging…

- Stay-at-home consumers will accelerate media, ecommerce and communications businesses.

- Media owners like newspapers going digital-only during the pandemic “will be a permanent change“.

- Enterprises will be more ready to enact digital transformation “because Q2 and beyond may be very tough and they’ll be willing to take the write-off” against digital investment.

Sorrell says the trend of “in-housing”, through which some brands have become keen to take on roles traditionally outsourced to ad agencies, is challenged by working from home.

Survey: 2020 will improve

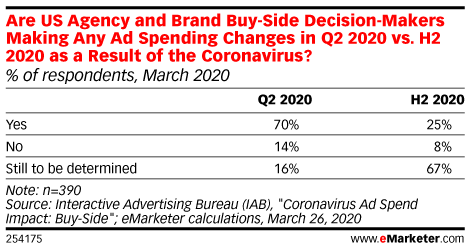

Surveys summarized by eMarketer show ad buyers think:

- the pandemic will have a “substantially more negative impact” than the 2008/09 financial crash.

- worst effects on ad spending will be in Q2.

- “most likely to take a hit are display, social media and digital video, with linear broadcast TV not far behind”.

- “paid search is the most likely channel to be retaining budget or receiving new money”.

- by Q4, most buyers think COVID-19 will have only a moderate or zero impact on their ad budgets.

This interview was conducted remotely, using Zoom.