So far in its evolution, header bidding – a software process revolutionizing digital ad sales – has been seen as a a seller tactic.

But could the technology also be a boon for buyers?

In this video interview with Beet.TV, the director of ad platforms at one of the two leading over-the-top TV device conduits says it could be.

Both sides benefit

“Header bidding is probably a good solution for both the buy side and sell side,” says Roku’s Youssef Ben-Youssef.

- “On the buy side, an agency or a DSP will be able to access a lot of inventory, improve their reach and reduce the fact that they have to reach out to each publisher and build the relationship with them before accessing that inventory.

- “On the supply side, this is one tool to help publishers sell their inventory in an efficient fashion and access a lot of demand that potentially they don’t have access to today.”

Ben-Youssef was speaking after PubMatic, an ad-tech platform vendor launched OpenWrap OTT, its header bidding solution for over-the-top TV services.

He acknowledges that header bidding, when applied to real-time TV, poses challenges on overcoming latency issues – the kinds of challenge that such vendors are having to tackle.

Rocking Roku

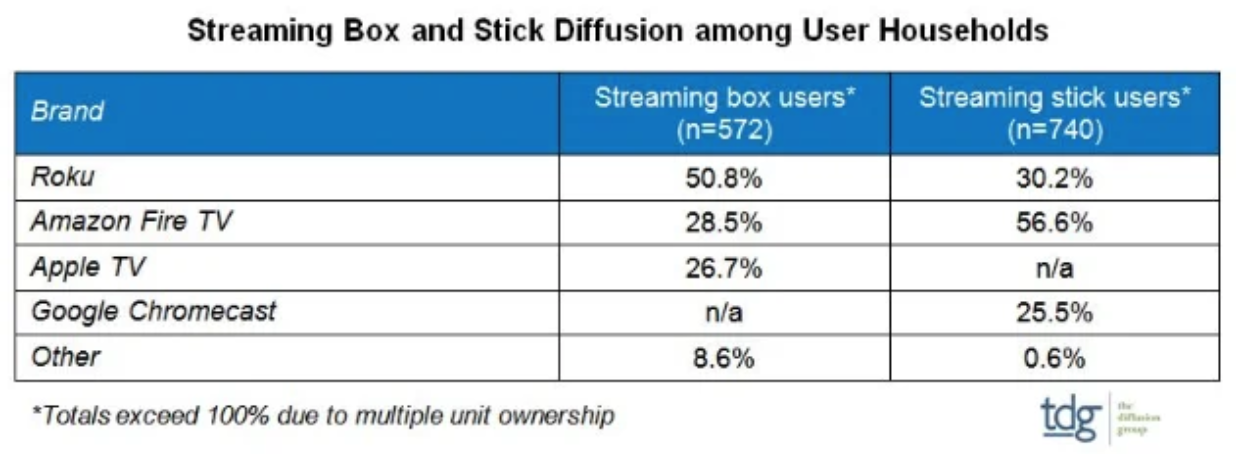

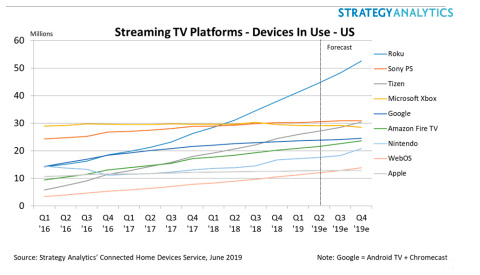

Ben-Youssef’s Roku leads the pack when it comes to share of the over-the-top (OTT) TV stick and box market, according to 2019 data from TDG and Strategy Analytics.

But Roku these days isn’t just a gateway to TV for other publishers and their advertising customers.

That deployment lead has given Roku an advantageous position both a direct ad sales house and a middleman.

The company made $742 million in advertising and commission in 2019.

The outfit holds first-party data on its users in unique identifiers it calls RIDAs, helping facilitate targeted advertising. Last year, Adobe Ad Cloud began matching marketers’ own audience segments to RIDAs, meaning buyers who use Adobe as a demand-side platform (DSP) can now end up buying Roku ads more easily.

Roku also offers 15- and 30-second video commercials but also background wallpaper sponsorships, sponsored content hubs or advertiser-funded free movie nights.

Roku also operates a marketplace where TV networks can sell their ads to target specific audiences.

All-in on programmatic

Roku previously acquired dataxu, a demand-side ad-buying platform, for $150 million, and then relaunched it as “OneView“.

“The OneView DSP will allow advertisers and agencies to reach the Roku households, about 39.8 million active accounts today,” Ben-Youssef says.

“Thanks to the awesome device graph that we have on the DSP, you can extend that reach actually to 105 million households through executing an omnichannel platform campaign.

“We understood from the beginning that all ads eventually will be running through programmatic.

“We sell our inventory in the programmatic entity fashion, also in PMP fashion. We do not sell our inventory in the open exchange and I talk a lot to publishers on our platform.”

This is from a Beet.TV series titled “The Accelerated Evolution of Programmatic OTT” presented by PubMatic. for more videos please visit this page.