What is it going to take for TV networks to front up and match big players like Google, Facebook and Amazon when it comes to offering advanced advertising opportunities?

Answer: learning to function with the same ecosystem mentality as the tech giants.

In this video interview with VAB CEO and president Sean Cunningham for TV Reset, a Beet.TV industry discussion series, 605 chief revenue officer Noah Levine gives his views.

Fragmenting TV

“Google, Facebook, Amazon, those are platforms, they’re also walled gardens,” Levine says.

“Until maybe eight years ago, television in and of itself was a very clean and tidy well-lit marketplace. It was very clear and easy to understand this television universe.

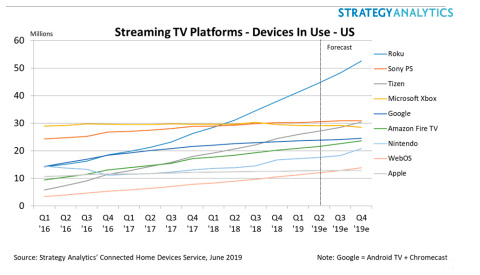

“What’s happened is, with the rise of streaming, particularly through the pandemic, we’re seeing streaming begin to rival and sometimes exceed linear viewership.

“And that has created a massive amount of fragmentation for the television universe.”

Platform play

Where, once, TV was a largely self-contained medium, with few operators and few places from which to buy advertising, now there is a plethora of services.

That runs contrary to the experience of the tech platforms, which operate and can reach their own ecosystems of users using their own attributes. Ad targeting there is seamless and effective.

That is a place Levine thinks television needs to get back to.

“We need to first solve for TV’s fragmentation issue by thinking of TV as a platform,” he says. “And then we can have the television universe compete with the search universe, compete with the browser-based display universe, compete with the native digital universe, and so forth.

“That’s really where we need to go as a marketplace. So I think it’s a different lens that we’re looking through.”

Back to cohesion

In the last couple of years, several initiatives, working groups and consortia have emerged to smooth the path to digital TV ad buying.

They hope to introduce commonality to the ways that audience data is constructed and to transacting in new, audience-centric TV platforms.

“Television in and of itself is no longer a cohesive entity,” says 605’s Levine.

EMarketer estimates that US TV ad spending will decline between 22.3% and 29.3% in H1 2020.

However, it forecasts US digital video ad spending could increase by as much as 7.8% during H1 2020 – or decrease by as much as 5.2% versus H1 2019.

Data-driven buying

605 provides aggregate set-top box and automatic content recognition (ACR) from 21 million households. It combines viewing data from

- Charter Communications’ Spectrum cable subscribers.

- Inscape, the company taking actual viewing data from Vizio TVs using automatic content recognition (ACR)

In February, 605 launched 605 Platform, a software system that will help programmers and advertisers plan, buy, assess and attribute advanced advertising campaigns.

It is the latest such platform to emerge offering ad buyers similar capabilities.

You are watching TV Reset, a leadership forum produced in partnership with VAB. The series is presented by 605 and Magnite. For more videos please visit this page.