Buyers and sellers of media increasingly talk about a “common currency” that helps to unify the measurement of audience exposure among traditional channels like linear television and newer digital platforms. Metrics that make comparisons of ad impressions more meaningful are becoming a reality, helping to support the ongoing growth in addressable advertising.

“TV as we know it will never be the same, and neither will its currency,” Carol Hinnant, chief revenue officer of Comscore, said in this interview with Beet.TV. “With the move to impressions, addressable fits more into the cross-platform view.”

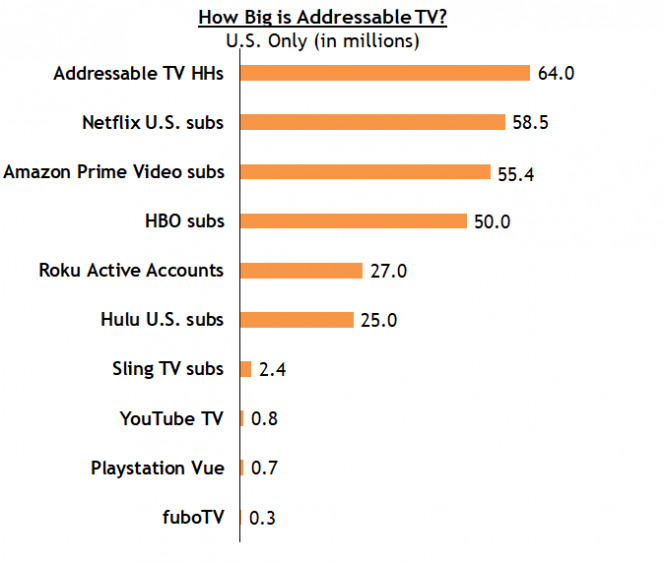

Fifty-four percent of TV households in the U.S., or 64 million in total, can be reached with addressable advertising, according to VAB. The trade group forecast that spending on addressable advertising will rise 33% to $3.37 billion this year as brands seek to refine their targeting of TV households. Addressable advertising lets them show different ads to different households during the same programming.

Source: VAB

Comscore in January will begin offering measurement of TV households as part of a ground-breaking collaboration with Comcast, one of the biggest multichannel video programming distributors (MVPDs) in the U.S. The companies in February announced a partnership to improve measurement with TV set-top boxes equipped to gather return path data (RPD) about viewing habits. Comcast previously had been very guarded about its valuable trove of TV viewer information.

“It’s the last hurdle to get to a true census-like measurement — having every major MVPD in the country provide return path data into our measurement,” Hinnant said. “That really is changing the marketplace.”

Outside the U.S., Comscore is expanding its footprint to measure connected TV (CTV) households in Europe as part of a recently announced partnership with Samba TV, a provider of cross-screen TV data and analytics.

Technological Challenges

Creating a common currency for media presents a variety of technological challenges, but the value of improved measurement far outweigh the shorter-term costs. It also will upend common metrics like C3, which researcher Nielsen introduced C3 in 2007 to measure average commercial minutes in live programming and playback by digital video recorders (DVRs) up to three days later.

“One of the biggest challenges for the programmers is the under-addressed piece of addressable,” Hinnant said. “If you get the addressed house going in, but the rest of the market received the standard linear ad, that is breaking the C3 measurement that is the currency today. As we move forward with an impression-based currency, it is much more likely that Comscore will be able to produce that measurement with the same precision that we produce exact commercial ratings today.”

Advertisers can expect to see more opportunities to reach targeted audiences and measure the results more precisely, especially as advertising video on-demand (AVOD) services like Hulu, Peacock, Pluto TV and Tubi grow more popular. With consumers only willing to spend so much on subscription video on demand (SVOD) services like Netflix and Disney+ that don’t carry ads, they’ll look for more free programming on AVOD platforms.

“The AVOD services are growing at a faster pace than the paid SVOD services,” Hinnant said. “That gives a lot of faith to the advertising industry that we’re still connected. Content always will be king.”

This video is part of Advancing Toward a Common TV Measurement Currency, a Beet.TV leadership series presented by Comscore. For more videos from the series, please visit this page.