Millions of U.S. households are connecting their TVs directly to the internet as on-demand video services supplement or replace their cable and satellite subscriptions. To reach those consumers, marketers are dedicating a bigger portion of their media budgets to over-the-top (OTT) and connected TV (CTV) platforms, making verification and viewability metrics more important.

“We’re seeing an increased role for CTV in our plans,” Chris Price, head of global digital marketing and media transformation at Coca-Cola, said in this interview with Beet.TV. “We have brands where CTV and on-demand represent a much more sizable portion than linear does.”

Audience Migration to CTV

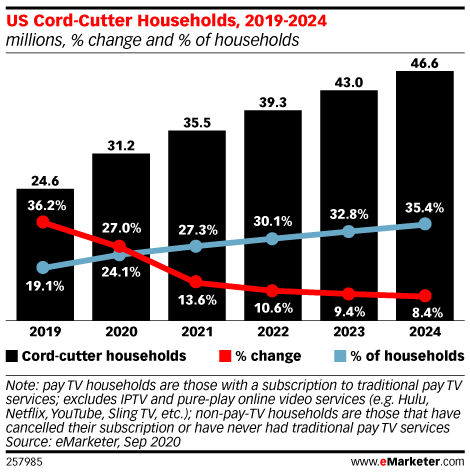

The soft drink giant sees an opportunity to improve the efficiency of its media spending among on-demand channels that have driven the cord-cutting trend in the past decade, though the pandemic has accelerated that shift in media consumption.

“Even before the pandemic, consumers were absolutely migrating to the space,” Price said. “We’ve seen ratings fall consistently year over year, and as marketers like us who were putting more money into linear TV were building excessive frequency.”

He cited research indicating that it’s 50% more expensive today to achieve the same 50% reach as it was five years ago, making on-demand channels more significant for mass-market brands. Those channels will grow in importance as the cord-cutting trend cuts the number of linear TV households.

“The consumer is making the choice for us,” Price said. “The consumer is migrating to on-demand. Once you realize you have got the ability to watch amazing, high-quality content and programming when you want, where you want and however much you want, why would you ever go back to linear?”

Ad spending on CTV is forecast to hit almost $8 billion in the U.S. this year, and nearly double to $15.6 billion by 2023, according eMarketer data cited by The Wall Street Journal.

Digital Lessons on Ad Fraud

As marketers shift their media spending to CTV platforms, they are increasingly vulnerable to ad fraud that saps the effectiveness of their campaigns. Fraudulent CTV traffic rates surged by 161% in the first quarter of 2020 from a year earlier, according to digital media measurement firm DoubleVerify, which has detected 1,300 fraudulent CTV apps.

Despite that threat, Price is optimistic that the media, marketing and ad tech industries will tackle the problem to ensure that CTV channels are sustainable platforms for advertising. He said marketers have learned the lessons of the past, when digital media were rife with fraud and bot networks that generated fake traffic.

“We don’t want to make that mistake again in CTV,” Price said. “We’re in a position to know what our expectations are and know what we expect from providers and publishers and know what measurement should be in place.”

You are watching “CTV Grows Up: Making a New Medium More Efficient & Effective,” a Beet.TV series presented by DoubleVerify. For more videos, please click here.