Comcast-owned FreeWheel is continuing to expand its buy-side offering by announcing its acquisition of Beeswax.

Beeswax offers a “bidder-as-a-service“, a DSP-like ad-buying software that sits in buyers’ own clouds and uses a software-as-a-service pricing model.

In this video interview with Beet.TV, FreeWheel general manager Dave Clark explains the rationale behind the acquisition, and how he sees 2021 panning out.

Expanding demand

“Our publisher client base – publishers and distributors in Europe and in U.S. – have been looking to us increasingly for help sourcing demand,” Clark says.

“They themselves are often out buying inventory, co-mingling others’ inventory with their own, and wanting to manage frequency across all of it.

“So, given the appetite that exists from our existing client base, we’ve been investing in that area over the last couple of years. We’ve had a lot of success with it, but adding Beeswax is just a huge accelerant to it.”

Bidding service

The deal also means that Beeswax now gets to do more in a connected TV (CTV) space that is rapidly expanding.

AdExchanger writes that its technology approach, giving users more control, will appeal to CTV buyers, given the higher rates of CTV inventory compared with standard display.

“We love that kind of philosophy that they’ve brought that to market,” Clark adds.

“They’re not a DSP, they haven’t gone out to compete against DSPs, but they’ve created this sort of customizable bidder, largely with the more sophisticated kind of buyers and media in mind.”

https://twitter.com/BeeswaxIO/status/1339614600782897152

Market growth

The deal is expected to close in January 2021. That will be a year looked to closely as the world continues grappling with COVID-19 effects.

“We saw advertisers this year, as they started to reenter the market, really prioritise more efficient, more targetable methods of reaching audiences, which just accelerated existing trend,” Clark says.

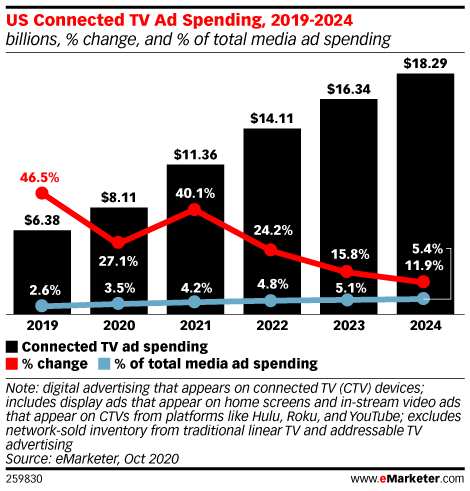

Connected TV ad spending next year will jump 40% to $11.4 billion in the United States, and make up 4.2% of total media spending, researcher eMarketer estimated.

EMarketer last November estimated programmatic TV ad spending will reach $6.69 billion in the US by 2021, more than doubling from $2.77 billion.

Advising Beeswax on the deal was LUMA Partners.