Marketers are seeking to boost the efficiency of their media buying as the economic fallout of the pandemic pressures their advertising budgets. The demand for greater efficiency makes transparency a bigger a priority in ensuring they’re reaching the right audiences with their media buys.

“Agencies and marketers are cost-conscious,” Sarah Warner Harms, vice president and agency platform lead at Xandr, said in this interview with Beet.TV. “They’re thinking about transparency and suppression of fees, and making sure they have direct and efficient access to supply.”

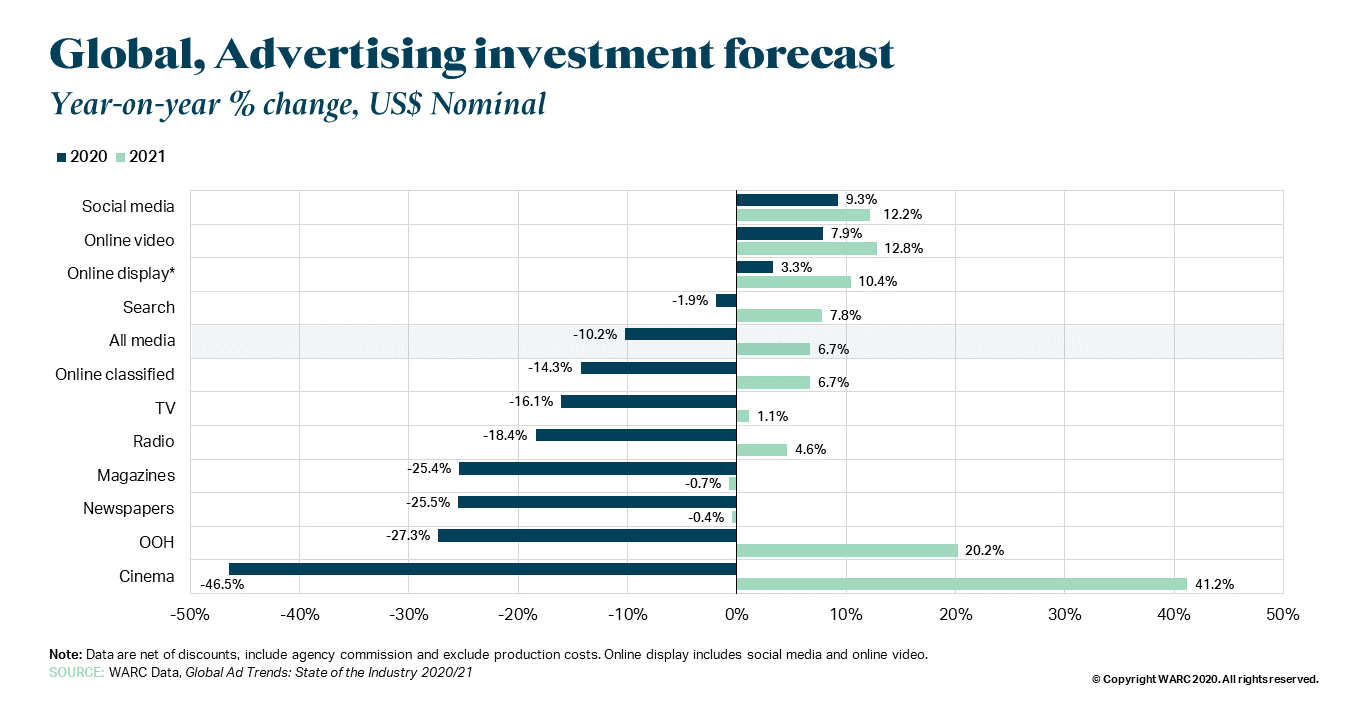

Global media spending will fall by 10% to $557.3 billion this year as the economic fallout of the pandemic weighs on marketing budgets, researcher WARC predicted. Contrasting with that decline, spending online video will grow by 7.9% this year and by almost 13% in 2021 as advertisers seek to reach younger consumers who are spending more time online.

Source: WARC

Contextual Ad Placements

As consumers shift their viewing to digital platforms, advertisers are looking for improvements in audience identification that helps to improve the efficiency of their media buys while also protecting consumer privacy. Advertisers also are basing their buying decisions on surrounding programming that’s most likely to appeal to their target consumers.

“You’re seeing an increase in contextual buying,” Warner Harms said, adding that there’s a need “for a scaled source of truth for identity, and making sure you can holistically manage that across your relationships and across different buying platforms.”

Part of her job at Xandr, which is AT&T’s digital advertising exchange, is dispelling misconceptions that programmatic media buys consist of deeply discounted fragment inventory that’s difficult to measure.

“The better business practices surrounding transparency and access to data really should give buyers peace of mind that platforms are really a place to activate and streamline their buying,” she said. “Another thing I like to talk about is a ‘second flavor of supply path optimization.’ Instead of access to supply, it’s access to content and making sure each buyer understands how and where they are getting access to certain television content.”

Programmatic TV ad spending will more than double to $6.69 billion in the U.S. by next year, EMarketer estimated last month. The researcher also forecast that CTV ad spending would reach $10.8 billion in the U.S. next year, and make up about 15% of total TV ad spending.

“Identity and connected television has been a challenge for the industry that we’re all collectively trying to solve,” Warner Harms said. “Making sure buyers understand and have relationships with the scale of platforms or media owners that have a true deterministic audience set — that’s where we see a lot of the focus and investment going.”

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.