If you want to know which way the new digital TV ad sales will go in the next couple of years, look toward the experience of digital display – but not too closely.

In this video interview with Beet.TV, Bill Murray, VP of programmatic solutions at Discovery, says a sprinkle of digital must be balanced with a healthy dollop of classical TV advertising culture.

That, Murray says, is how programmatic can make in-roads to the TV advertising ecosystem.

Think different

“A few years ago, I naively thought that you could just take a digital ad server and apply it over to video – (that) anything IP based would be the same,” Murray admits.

“(But) a lot of the logic that’s necessary to deliver ads in CTV environments is very different from what we’re used to in the display world. The concept of ad breaks, of ad separation, competitive separation – while they’re important on a page on desktop, there’s scrolling that occurs, so you never really see them side by side. In the CTV environment, that’s much different.

“So it (must be) a combination of trying to maintain the rigidness, and security that existed in the standard linear scheduling with the advancements and targeting that we’ve developed over the years for primarily for display and now that we’re trying to convert over to video.”

Programmatic mover

Murray’s Discovery was an early advocate of selling connected TV ad space programmatically – that is, with automation.

In 2017, it teamed with SpotX to manage inventory and began offering programmatic guaranteed campaigns.

Four years on, Murray says that programmatic stands proud beside the traditional, direct method of TV ad sales.

“Discovery’s found value in leveraging it as an additional monetization channel,” he says. “It’s treated as an equal sales channel and not a secondary, or in some cases I know some organisations as an afterthought.

“Aside from situations where we have sponsorships or direct sold, it’s all available. We don’t syphon off inventory or particular ad breaks or things like that as programmatic only.”

Programmatic TV’s growth

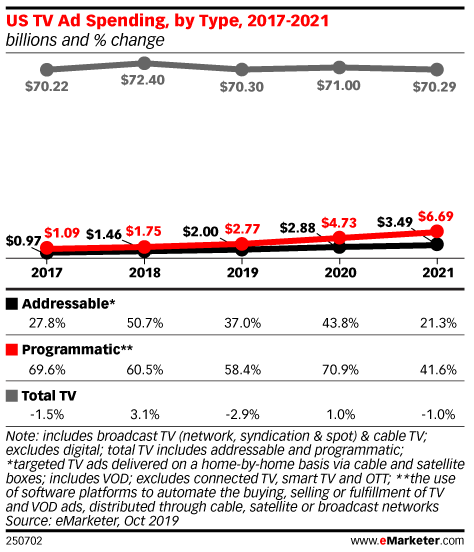

EMarketer last year estimated programmatic TV ad spending will reach $6.69 billion in the US by 2021, more than doubling from $2.77 billion. That makes it a still-small but fast-growing part of the overall TV ad spending pie.

In fact, more TV money is spent through these software platforms than in addressable TV – that is, ads on household-targeted cable and satellite systems.

Ad buyers are getting interested by the ability to target specific audiences or households, the ability to use other data in doing so and the ability.

Header bidding ahead?

But Discovery’s Murray thinks he knows a way to help bring more spend in to the ecosystem.

He is hoping to see the emergence of “header bidding” – the technology which allows publishers to entertain bids from multiple demand sources simultaneously, thereby achieving higher bids – in connected TV.

“Most publishers are still using waterfalls in CTV,” he says, referring to the traditional, sequential method of ad bidding. “And we all, over the course of display, have learned the disadvantages of those.

“So I think not only are there financial incentives for publishers – I think that there are also opportunities to improve the user experience, while managing a more advanced and unified auction environment.”

You are watching “Making CTV Happen: A New Ad Infrastructure Emerges,” a Beet.TV leadership video series presented by Publica. For more videos, please visit this page.