Sports viewership just went through one of the most volatile periods in recent memory, with the pandemic having a significant effect on sports leagues and consumer behavior. Amid limitations on fan attendance, sports entertainment became a more virtual experience that’s likely to have a lasting effect on reaching younger consumers.

The National Basketball Association, National Hockey League and Major League Baseball were among the league that suspended operations in the spring as lockdowns went into effect. The pent-up demand for sports programming led to an initial surge in viewership, though audiences become more fragmented as leagues overlapped each other in competing for viewer attention.

Leagues reformatted their live events to limit attendance by fans, many of whom turned to digital channels to find sports-related content. Motors sports performed well as NASCAR and IndyCar racing were among the first to return to television with live events.

“What we saw was a real ratings boost on the return to sports,” Jon Stainer, managing director of Nielsen Sports Americas, said in this interview with Beet.TV. “We saw a general decline once seasons got into full flow. The exceptions to that were motor sports and golf that managed to sustain fairly strong viewing year-over-year despite the pandemic and the competitive programming.”

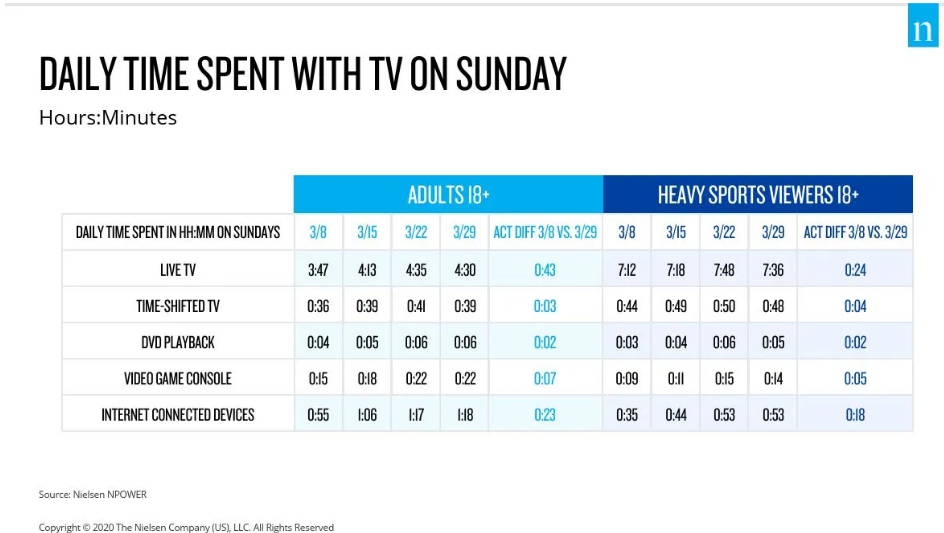

Source: Nielsen

People ages 18 to 24, and those 55 and older increased their sports consumption from a year earlier, Stainer said. As sports fans looked for fresh programming, they boosted consumption of digital content. In the U.S., the top five digital platforms saw a yearly increase of 11 million consumers, ages 25 to 54.

The trend showed “the increased media fragmentation in the marketplace, but also consumers going to digital platforms for their sports fix,” Stainer said.

Sports fans grew more aware about safety concerns with attending live sports as the year wore on, and demonstrated a growing hunger for live attendance. The portion of fans who agreed that sports leagues needed to protect their safety grew 10% from May to October, making up 74% of the fan base.

The percentage of fans who agreed that the best way to express fandom was by attending a live game expanded by 24% during that period to about two-thirds of the fan base, Nielsen found in its exclusive surveys.

Opportunities for Advertisers

Because many sponsorship deals with sports leagues consist of multiyear contracts, the level of investment in sports wasn’t affected dramatically. Instead, part of the spending shifting to digital channels that become key touchpoints with fans.

“The big opportunity for brands is surviving and thriving in this hybrid world that we’re going to live in, where live events and attending live entertainment are going to be very important, but so is playing in virtual world,” Stainer said. “The big thing for the sports industry is how they best play in the virtual and digital environment, alongside the live environment where they’ve thrived for so many years.”

Younger consumers are more likely to consume media on smartphones, making digital video and social media platforms a key part of engaging them with sports content.

“Sports needs to play where the younger viewers and consumers are congregating — that needs to be more in a virtual and digital world,” Stainer said. “Sports needs to draw on a lot of the success of the games and esports environment.”

Last year was notable for the growth in esports as viewers flocked to livestreaming channels like Twitch and YouTube Gaming, which carried gaming tournaments that had been reformatted as virtual events. Younger consumers also tended to a show a preference for short-form video on apps like TikTok.

Getting the attention of younger consumers with highlight reels that are easier to view is a key a part of transforming them into viewers of games that last several hours.

“There’s a lot of learning lessons to take from the esports and games environment into the sports business,” Stainer said. “It’s about crossing the divide from the linear and live experience into this digital and virtual experience.”

You are watching “Live Sports 2021: What’s Next on TV,” a Beet.TV + VAB leadership video series presented by Effectv, a Comcast company. For more videos, please visit this page.