The growing audience for advertising-supported streaming audio is driving a shift in media spending as marketers seek to reach listeners of music and podcast programming. The portability of smartphones and the popularity of unlimited mobile data plans help to reach consumers wherever they are, while smart speaker ownership is rising among connected households.

“I’ve been in audio for about 20 years, but there’s really a lot of attention coming to audio today, which is fantastic,” John Morris, vice president of streaming and on demand at ad management platform WideOrbit, said in this interview with Beet.TV. “Audio is driving significant revenue for a lot of our broadcast clients, who now have repurposed or turned their over-the-air audio products digital, and are doing fantastic jobs monetizing that inventory both through their direct-sold efforts and also programmatic efforts.”

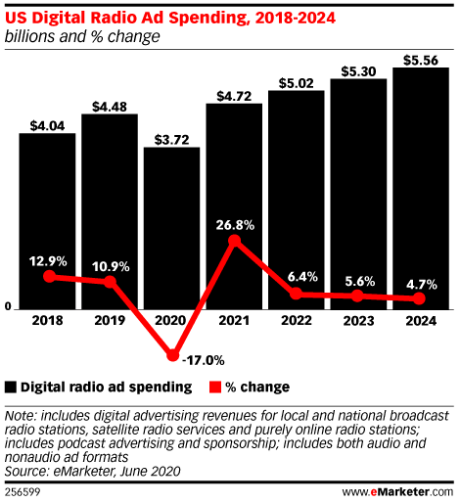

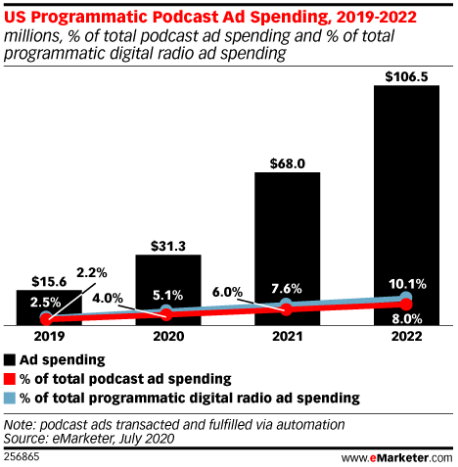

WideOrbit not only provides an advertising traffic system that’s used by about half of the terrestrial radio stations in the U.S., but also provides technology for streaming audio, podcasting and programmatic ad sales. U.S. digital radio ad spending will rebound by 27% to $4.72 billion next year, researcher eMarketer forecast, and growing portion of that spending will go through programmatic placements — including those in podcasts.

Source: eMarketer

“That kind of omnichannel buy is increasingly important, as is the type of data that we can provide to an advertisers about the audience,” Morris said. “That’s where our partnerships with folks like Tru Optik become really important, because we can surface that data to the advertisers.”

WideOrbit is seeing most requests for proposal (RFPs) include information about audience segments, helping to supplement information about geography and device type that help with targeting. Stricter privacy rules, like those enacted in California, are challenging for advertisers and every kind of media channel, including audio.

Source: eMarketer

“Privacy restrictions … have changed the way that industry providers like WideOrbit and others think about how we’re able to see users go from point to point,” Morris said.

Some platforms like Apple Music are subscription-based, and its data reporting for podcasts is very limited to basic analytics that don’t include audience data. Other platforms have ad-supported tiers that let marketers insert radio-like spots into music, while podcasting can include a mix of audio spots and host-read ads.

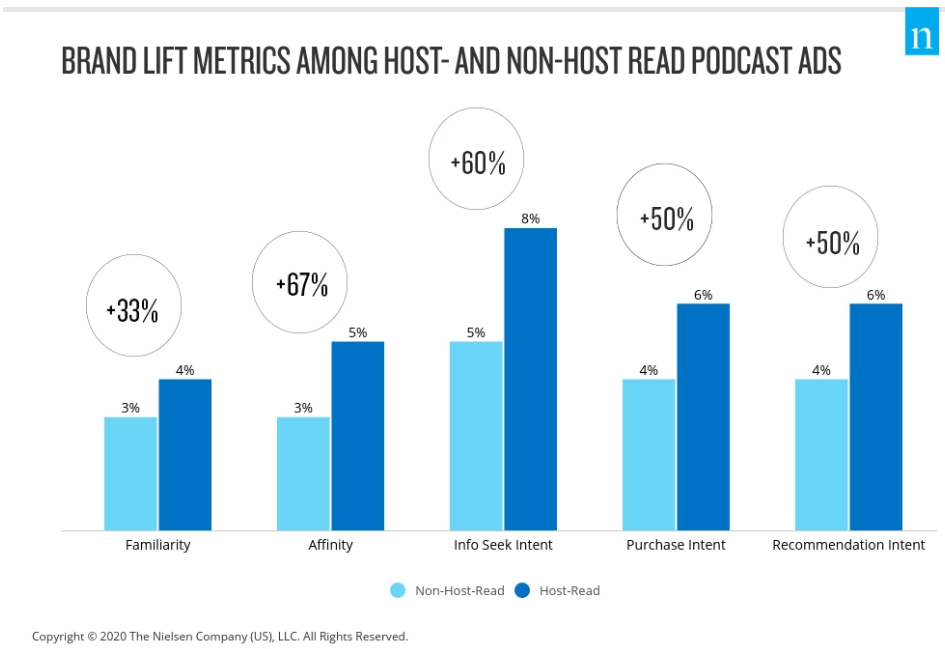

Source: Nielsen

“We always have an idea of where the user is connecting from,” Morris said, while also acknowledging the data can be limited. WideOrbit has a software development kit (SDK) that audio platforms can integrate for analytics and reporting, though not every content provider uses it.

“We’re not guaranteeing that they’re going to implement the SDK, or that they’re going to share information they have that they think is valuable or proprietary. It does create a challenge,” Morris said.

As the audience for digital audio grows, Morris expects to see the programmatic marketplace also develop further, as it has with digital display and video advertising.

There are a lot of DSPs [demand-side platforms] that are very video-focused that are coming to audio,” Morris said. “It feels like a rising tide” that will lift all boats in the digital audio marketplace, he said.

You are watching “Advertisers: Turn Up the Volume on Streaming Audio,” a Beet.TV leadership series presented by TruOptik, a TransUnion company. For more videos, please visit this page.