If you are a marketer that wants to reach younger viewers, you should not necessarily go to traditional TV anymore.

In this video interview with Beet.TV, Dan Robbins, VP of ad marketing and partnerships at streaming TV platform Roku, says that key audience has made a great migration.

And that poses challenges – but also opportunities – for how to reach them.

Chasing viewers

NEW: @Roku to acquire @Nielsen's advanced TV advertising biz

— About 100 Nielsen employees moving over to Roku

— Deal gives Roku access to the technology to scale digital TV adsInterviews with execs from both companies in full story from @axios below:https://t.co/z8CW6cSral

— Sara Fischer (@sarafischer) March 1, 2021

“We see a tectonic shift on the buy side, and it’s really accelerated within the last six to 12 months,” Robbins says. “Linear TV declines have accelerated to the point where finding a younger, light TV-viewing audience is increasingly challenging.

“At the same time, we’ve seen that streaming is surging. More than a third of Americans no longer have a paid TV subscription, and the amount of time spent with streaming is increasing.

“So, if you want to reach those cord cutters and those light TV viewers, you want to do that with better identity data, with more access to inventory, and better performance.”

Market position

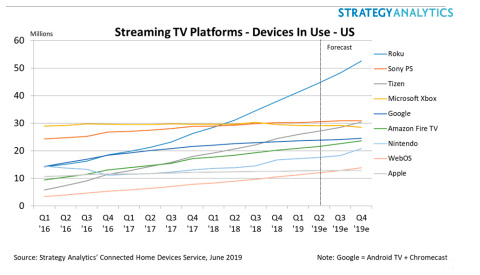

Roku is the leading streaming TV platform device in the US and, with a growing offering to advertisers, the ad revenue it makes from that position is growing.

Last year, the company unveiled OneView, its own ad-buying platform.

Roku made $471.2 million in revenue from its platform in Q4 2020, 81% up on the year before, according to its recently-filed earnings.

This month, Roku announced it is acquiring Nielsen’s Advanced Video Advertising (AVA) business, which includes Nielsen’s video automatic content recognition (ACR) and dynamic ad insertion (DAI) technologies, to accelerate its launch of an end-to-end DAI solution for TV programmers.

And it also announced it was acquiring rights to shows from ill-fated Quibi.

Best of both

For advertisers, the appeal of streaming TV services is not just accessing a demographic on the move – it is in mixing the best of both media worlds, Robbins thinks.

“What TV streaming brings ultimately is the branding power of the television screen mixed with the performance and attribution of the digital world,” he says.

The data seems to bear Robbins out:

- FrndlyTV, a virtual MVPD, recently said it had found 65% better return on investment from advertising its suite of channels through Roku that through a large social platform.

- Lexus recently increased its unique reach by 35% without spending more marketing dollars, by using Roku’s OneView to put all its data in one place, Robbins says.

Average revenue per Roku user has risen fast, from $7.83 in 2016 to $28.76 in 2020.

And the outlook could get better from here. According to Robbins’ company, in 2020, 38% of all smart TVs sold in the US were Roku TV models.

You are watching “Seeing Around Corners: Media Decisions During a Period of Disruption,” a Beet.TV leadership series presented by Standard Media Index. For more videos, please visit this page.