The major shift in people’s television viewing habits between traditional linear television and streaming video has challenged advertisers and media companies to measure that activity more accurately. Marketers are demanding metrics that help them to avoid oversaturating some media channels while neglecting others.

“It’s clear that advertisers are having a problem seeing this in their measurement. It feels like a measurement problem,” Cole Strain, vice president of measurement products at advertising and analytics company Samba TV. “They’re sending the same message over and over again to the same viewers.”

Growing Ad Saturation on Linear TV

The need for improvements in advertising efficiency is highlighted in Samba TV’s quarterly “State of Viewership Report” that gathers data from more than 40 million TV devices. The company analyzed about 24 billion hours of linear and streaming TV data in the fourth quarter of last year.

“What we’re seeing is a growing oversaturation of advertising against a shrinking linear audience,” Strain said.

While 97% of advertising dollars were spent on linear TV, marketers only reached 55% of viewers in the final three months of 2021, Samba TV found. Linear ad impressions rose 19% from a year earlier, but the unique reached audience was up only 6%.

“These audiences were less diverse than the national average,” Strain said. “They were older. They were lower income. We’ve been reaching them with such a high frequency that is approaching oversaturation.”

Advertisers can improve the efficiency of their campaigns by harnessing data that are better indicators of reach and frequency, and include connected TV. Traditional metrics such as gross rating points (GRPs) and target rating points (TRPs) for audience size don’t capture outcomes that advertisers seek.

“As the linear audience continues to shrink and move more into streaming and CTV spaces, the frequency problem is going to continue to grow,” Strain said. “What we are seeing most commonly is a shift away from old metrics — from GRPs and TRPs — into something that’s more actionable and measurable.”

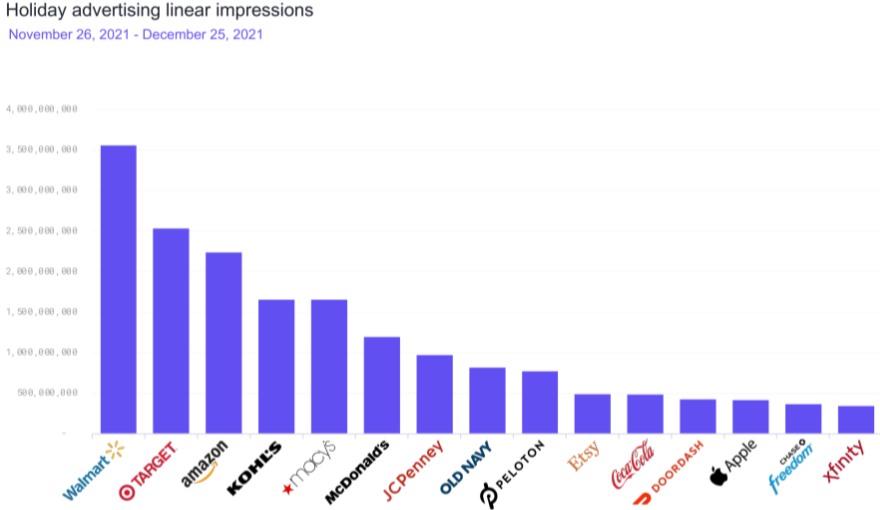

Differences Among Retail Chains

Last year’s holiday shopping season highlighted how different retailers optimized their campaigns, Strain said. Department store chain Kohl’s outperformed rivals such as Walmart, Target and Macy’s in reach and frequency.

Source: Samba TV’s Q4’21 State of Viewership Report

He recommends that advertisers adopt other kinds of measurement currencies to improve comparisons of return on investment (ROI) among different media channels.

“GRPs have a tendency to obfuscate the problem,” Strain said. “They commingle reach and frequency so it’s hard to be able to see the truth of what it was that you were actually delivering.”