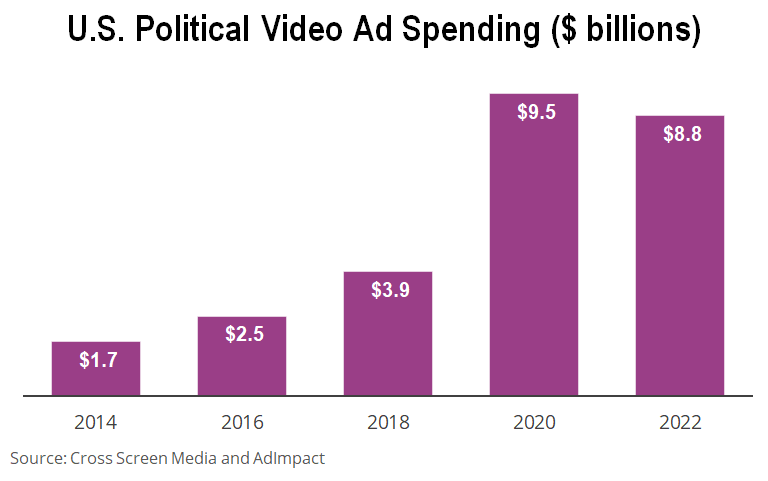

Political campaigns increasingly face the challenge of getting their message out to voters who divide their time among a wider variety of media channels and viewing devices. Those campaigns are expected to spend as much as $9 billion, including $1.8 billion on connected TV, during this year’s midterm election cycle.

As these campaigns seek to extend their reach, E.W. Scripps Co. is leading an effort to provide political media agencies with access to connected TV audiences. The company this month rolled out the Scripps Political CTV Consortium to provide a singular source of advertising inventory among broadcasters including Cox Media Group, Capitol Broadcasting Co. and Graham Media Group.

“Apart from being a 143-year-old company. E.W. Scripps Co. has had a full-time political sales office in Washington, D.C., for the last 12 years,” Ken Ripley, vice president of sales at Scripps Networks, said in this interview with Beet.TV. “We understand the political marketplace from the basis of where we do our business and how we do our business inside the Beltway.”

Having a presence in the nation’s capital is important because multiple media agencies that specialize in political campaigns have offices there.

“It may surprise some people to learn that over 80% of all political dollars each election year are placed from within the D.C. marketplace,” Ripley said to Rob Williams, senior editor for Beet.TV. “The parties can better direct their fundraising efforts through the agencies in D.C., and their expertise at those agencies are to be able to affect not just the presidential election, but practically every election.”

Single Point of Contact

Scripps is exclusively working with sell-side platform Magnite to make CTV inventory available to agencies and programmatic buyers. The goal of the Scripps consortium is to offer a “one-stop shop” for political agencies that have a narrow window of time to reach voters quickly for party primary and general elections.

“They’ve got a lot of states, a lot of elections, a lot of different data that’s constantly coming in,” Ripley said. “To be able to collect broadcasters together and act as a single point of contact makes us much more effective in being able to service the agencies.”

California Is a Battleground State?

Every election cycle brings its own set of battleground races as voter sentiment shifts, incumbents retire or challengers emerge. This year brings key races in Florida, Georgia, Pennsylvania, Arizona, Texas, North Carolina, Ohio, Wisconsin, Michigan – and notably, California, where Gov. Gavin Newsom (D) last year was retained in a recall election.

“California is practically never a battleground state,” Ripley said. “There’s a gubernatorial race there. There’s going to be a lot of money that plays out in California.”

The most recent population survey from the U.S. Census Bureau is reshaping the political map as states either lose or gain seats in the House of Representatives.

“There’s a lot more seats open that didn’t used to be open,” Ripley said, “and there’s a lot on the line for both parties to do the best they can this midterm.”

Importance of Local News

Scripps operates 61 broadcast stations in 41 markets, making the company a key source of news about local elections.

“Local news is a vital lifeline within every market,” Ripley said. “The people within the market who are watching that broadcast are the ones who want to be informed, and those are the kind of voters that these campaigns want to reach.”

Scripps continues to broaden its reach as more media companies join its CTV consortium.

“This is going to continue to gain steam,” Ripley said. “Our goal isn’t just to make it through the midterm. Our goal is to keep this going and growing for the next presidential and for the next 20 years after that.”