When Amazon Prime Video began streaming live Thursday Night Football (TNF) in September in a $1 billion-a-season deal, it was hailed as a revolution in sports broadcasting.

Traditionally, it might have taken days or weeks to learn just how successful the show was for advertisers. Kevin Krim found out the next morning.

In this video interview with Beet.TV, Krim, president and CEO of ad data company EDO, explains how his service can offer real-time insights on live-sports ad effectiveness.

The data is in

It just doesn’t get better than Al Michaels calling prime time football. 🐐

🏈: @Chargers vs. @Chiefs#TNFonPrime | Watch NOW on @PrimeVideo pic.twitter.com/tqF2PYl28J

— NFL on Prime Video (@NFLonPrime) September 16, 2022

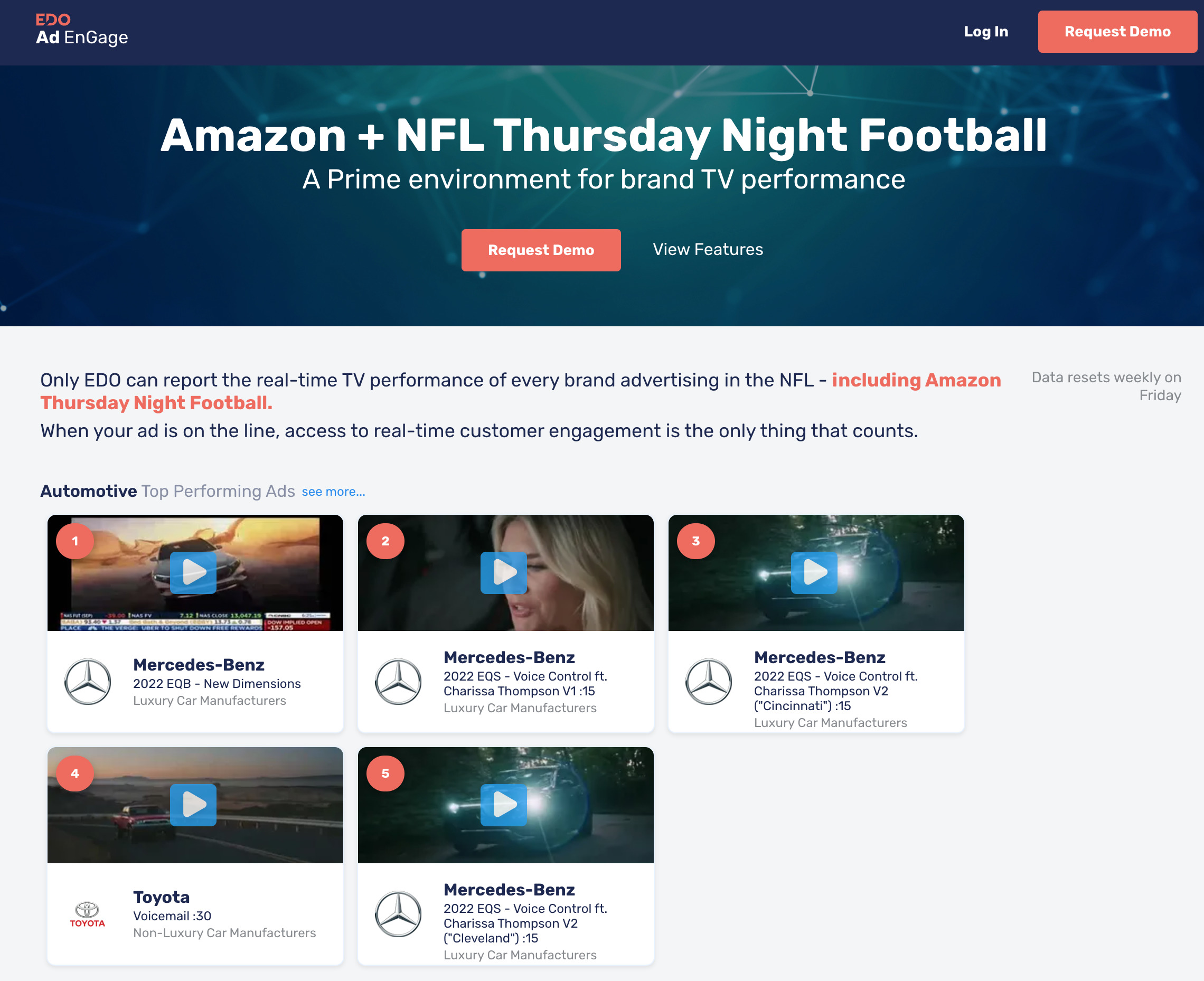

Amazon Ads is making a big deal out of TNF. With sponsors like Cruise Line, DraftKings, Audible, Little Caesars and Mercedes-Benz USA, the outfit has used formats including on-screen pizza-ordering QR codes and odds data powering a TNF Predicts segment.

How successful are the ads around the new TNF? According to EDO data seen by Beet.TV, the company counted:

- 91 brands.

- 424 ad airings.

- 5.2 billion total impressions.

- 231 unique ad creatives.

It found:

- Mercedes-Benz is the highest-impression brand, with 200+ million impressions.

- 50+ brands advertising around Thursday Night Football this year are new to the spectacle versus last year.

TV drives web visits

EDO technology “measures the spike in consumer engagement behaviors, such as online search, for a brand in the moments after a TV ad airs.

It does that by correlating search and brand website visitation against ad airing data for every 30- and 15-second spot running across more than 120 broadcast and cable networks plus major AVOD platforms in the US.

“Live sports is special,” Krim says. “It is the economic driver of TV advertising, and TV advertising is the driver of the economics of live sports. It can drive a large and engaged audience.

“Web searches and website visits in the minutes following, or in the weeks following an ad airing, is an incredibly powerful outcome measurement signal because it’s a consumer in a very honest and direct moment saying, ‘I want to know more, I want to see more, I want to buy’.”

Football drives virtual footfall

And Krim says Thursday Night Football is driving significant actual audience brand engagement.

“On a per person basis, they were more engaged in the ads than virtually anything we’ve seen on television,” Krim says. “This is special.

“The NFL has always been the king of TV advertising on a per person, per second basis. People were 68% more likely to search and engage with the brands in the minutes following an airing on Thursday Night Football on Amazon than they were on average across all of NFL games live.

“They were almost two and a half times more likely to search than the average for all regular TV ads on prime time.”

AND WE'RE OFF!

TNF Tonight is LIVE now on @PrimeVideo. We're getting you ready for tonight's Colts vs. Broncos showdown.#TNFonPrime | @littlecaesars pic.twitter.com/xZyqtqMmx3

— NFL on Prime Video (@NFLonPrime) October 6, 2022

Time of the essence

For Krim, speed of access to performance data is the new critical component.

Amazon says the first TNF achieved average minute audience (AMA) of 13 million viewers and was the most-watched programme of the day for all age groups. That is according to its source, Nielsen National TV Services, Live+Same Day, which includes “fast national” viewer data for the previous night.

But such data typically lacks the granularity of brand-level messaging within programming.

“We’re able to report to everyone, all of our clients, the next morning, how Thursday Night Football on Amazon Prime did,” Krim says.

“And that’s special. It took Nielsen a week to get their ratings data out.

“You can’t wait for lagged data. You can’t wait for a brand survey or for Nielsen’s audience ratings, when you’ve got to make critical decisions.”