MARCO ISLAND, FL – Amazon, Netflix and Disney are among the media owners that have started to sell advertising on their streaming services, giving brands more ways to reach U.S. consumers. Those audiences include people whose viewing habits shifted away from traditional linear television during the pandemic, which temporarily halted live sports and the production of new shows and movies.

“We’re beginning to see an influx of supply,” Alex Stone, senior vice president of agency partnerships and advanced video at media agency Horizon Media, said in this interview at the IAB Annual Leadership Meeting. “For a long time, from like 2018 to 2022, we all saw this consumption habit changing but there wasn’t so much supply for ads.”

The additional advertising inventories give marketers more options in how to run campaigns and take steps to prevent showing the same to the same viewer too many times, or what is known as frequency capping.

“We like to be in ‘tier one’ content,” Stone said about placing brands amid the highest-quality programming that engages audiences and makes them more amenable to watching ads. “Ehether that’s broadcast or whether that is your premium YouTube select inventory – that’s really where we are gravitating to.”

Walled-Garden Challenge

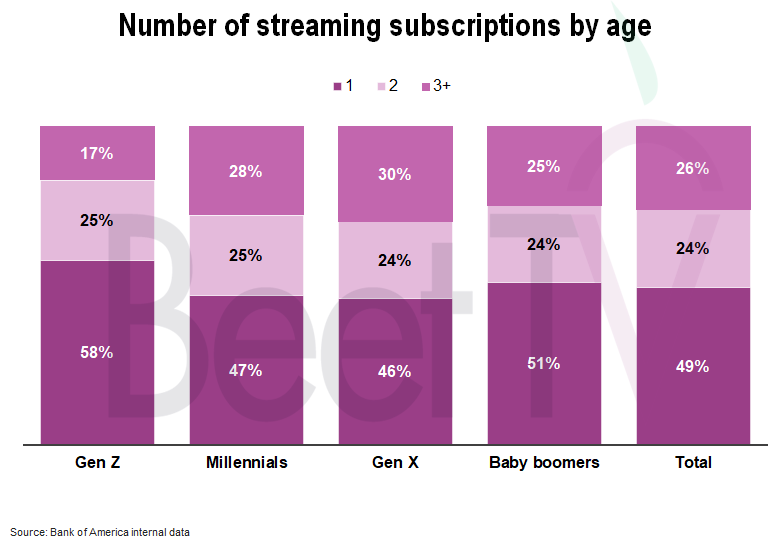

With the explosive growth in streaming, television audiences have become more fragmented among hundreds of video apps that act as umbrellas for a variety of programming or for more specialized content. Each of these apps typically asks viewers to register with a name and email. However, because apps don’t share account information with other platforms – becoming what’s called a walled garden – marketers face greater difficulties in measuring people’s exposure to ads.

“The current challenge that we face is the walled gardens,” Stone said . “Each walled garden is saying ‘it won’t be a challenge if you just use our DSP [demand-side platform], but that creates a different walled garden scenario that blocks out different content from appearing in a universal frequency measurement platform.”

Transactional Television

He said media buyers look at cost per incremental reach point when they’re managing campaigns and measuring ad frequency. These efforts come as television becomes more transactional as people hook up their sets directly to the internet.

“Now, you could track business outcomes through video, whether it’s utilizing QR codes or some kind of interactive like retail shopping mechanism,” Stone said. “That video is no longer just at the very top of the purchase funnel — whether you want to call it the funnel anymore — but it could achieve other KPIs mid- and lower funnel.”

You’re watching ‘Digital Media in Transition’, a Beet.TV Leadership Series at IAB ALM 2024 presented by Sharethrough. For more videos from this series, please visit this page.